Account Access

Digital Banking

Digital banking is an easy, convenient way to check account balances, pay bills, transfer funds, view e-statements, and more! First-time users will have to register for digital banking before they are able to log in. Once registered, members can log in to digital banking from a web browser or mobile app to securely access their account 24/7.

eStatements

eStatements are electronic versions of your account statements. eStatements are free, let you access eligible account statements online, and offer:

- Speed: Faster delivery of statements, no need to wait for the mail.

- Security: Secure electronic delivery, no paper statements in your mailbox.

- Convenience: Historical statements available online.

You can enroll in eStatements in the following ways:

- Contact the credit union at 865-482-4343 during posted, branch lobby hours, and one of our Member Service Representatives will assist you.

- Message us via digital banking that you’d like to enroll in eStatements.

- Self-enroll using the eStatement platform found by clicking the ‘eStatement’ link in the main, left-hand navigation when you’re logged in to digital banking.

eStatement FAQs

You can enroll in eStatements in the following ways:

- Contact the credit union during posted, branch lobby hours, and one of our Member Service Representatives will assist you.

- Message us via digital banking that you'd like to enroll in eStatements.

- Self-enroll using the eStatement platform found by clicking the 'eStatement' link in the main, left-hand navigation in digital banking.

In order to sign up for and receive eStatements you need:

- A connection to the internet.

- An active email address.

- A current version of a program that accurately reads and displays PDF files (such as Adobe acrobat reader).

- A computer and an operating system capable of supporting all the above. You will also need a printer if you wish to print out and retain records on paper and electronic storage if you wish to retain records in electronic form.

You can access your eStatements in digital banking (online or mobile).

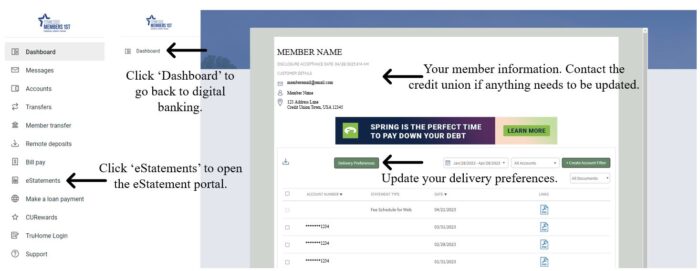

- Log in to digital banking.

- Click on the 'eStatements' link in the main left-hand navigation menu. The page will reload and bring up the eStatement page.

- At any time you want to return to digital banking, click the 'Dashboard' link in the left-hand navigation menu.

If you are on a mobile device, or a device with a smaller screen, we suggest turning your screen to landscape (horizontal) orientation. You should then be able to see and enter your code. If you continue having issues, contact the credit union during posted, branch lobby hours at 865-482-4343.

You can update your statement delivery preferences anytime through the eStatement portal on digital banking.

- Log in to digital banking.

- Click on the 'eStatement' link in the left-hand navigation menu. This will open up the eStatement portal.

- Click the 'Delivery Preferences' button, a pop-up box will appear.

- Select your delivery preference

- Online and By Mail = Printed received via USPS AND eStatement

- Online with Email = eStatement only

- If you'd like to be removed from eStatements and ONLY receive a printed statement via USPS, please contact the credit union at 865-482-4343.

Please note, changing your delivery preference will only impact upcoming statement delivery. You can also contact the credit union at 865-482-4343 during posted, branch lobby hours to update your statement preferences.

To view, download, or print your eStatement:

- Log in to digital banking.

- Select the 'eStatement' link in the main, left-hand navigation menu, the eStatement platform will load.

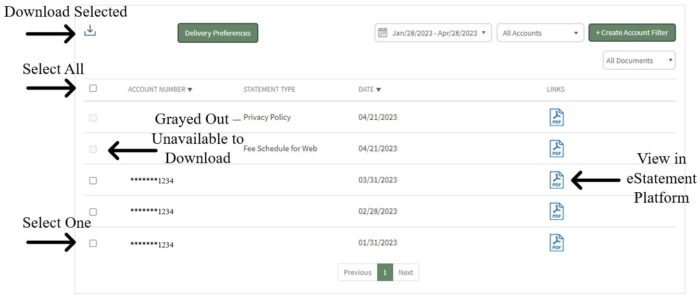

- Select the statement you want to view, download, or print from the documents list.

- On the right-hand side of the screen, under the 'Links' column, click on the PDF icon to open the document PDF in a new tab.

- Use the quick links at the top right of the new tab to download or print your statement. You can also use your device-specific options to download, save, and print.

Additional Bulk Download Option: You can also download statements and documents available in the eStatement platform in bulk.

- Log in to digital banking.

- Select the 'eStatement' link in the main, left-hand navigation menu, the eStatement platform will load.

- In the document listing, click the box to the left of the document you'd like to download or click the box at the top of the document listing to select all available downloads. Please note, some items may not be available for download, these will have a grayed out box.

- Select the download button at the top of the document listing section of the eStatement platform.

All-In-One DIGITAL Banking & Remote Deposit App

The free Tennessee Members 1st Federal Credit Union digital banking app provides secure 24/7 account access right at your fingertips! Check account balances, deposit checks, transfer funds, track expenses, and more. Available for both Apple and Android devices, you can download the app by clicking one of the links below or searching TN Members 1st FCU in your app or play store.

audio Access

With Audio Access, you can complete transactions on your account from any touch-tone phone, including transferring money, checking balances, making loan payments, and many other options…all free! Use Audio Access by dialing 866-228-8884 (toll-free).

Audio Access Update FAQs

Remote Deposits

Members are not automatically enrolled in Remote Deposit Anywhere. You must request enrollment in Remote Deposit Anywhere through your digital banking. Members must have their full name, phone number, address, and email address on file in order to be eligible for Remote Deposit Anywhere. If any of this contact information is missing from your account, your enrollment request will be denied. To enroll:

- Log in to digital banking.

- Click on 'Remote Deposits' in the main left-hand navigation menu or on the 'Deposit' tile at the top of your dashboard (only available in the mobile version of digital banking).

- Select the account(s) you wish to enroll in Remote Deposit Anywhere. Please keep in mind that only certain accounts are eligible for this service.

- Our Member Service staff will review your enrollment.

- You will receive a message via digital banking that states your Remote Deposit Anywhere Enrollment has been accepted or denied.

Remote Deposit Anywhere enrollment will be automatically denied if you have not been a member for over 30 days. Not all accounts and/or members are eligible for Remote Deposit Anywhere. You are welcome to resubmit enrollment for Remote Deposit Anywhere at any time. Contact our Member Service Department at 865-482-4343 if you have questions about your Remote Deposit Anywhere eligibility.

Mobile deposit is available for all eligible checking accounts, but you must enroll first. Mobile deposit can only be done through the mobile app.

- Log in

- Select Deposit under your checking account OR select Deposit Check from the slide out menu in the mobile app

- Click Enroll Account and go through the sign-up steps

- Once your request has been processed and approved, tap Deposit a Check

- Enter the check amount

- Tap Continue

- Select the account to deposit to

- Take a picture of the front of the check and tap continue

- Take a picture of the back of the check and tap continue

- Verify the information and tap Submit

Mobile deposit limits are based on the type of checking account you have. These limits include a daily dollar amount and number of items deposited daily. If you have specific questions, contact the credit union at 865-482-4343.

As an important regulation reminder for members using Remote Deposit, please remember to endorse the back of the check with:

- For Mobile Deposit only @TNMFCU

- Your account number

- The deposit date

- Your signature

If this information is not present, your deposit may be delayed or unable to process. Visit your local branch or contact us at 865-482-4343 if you have questions regarding Remote Deposit Anywhere endorsement requirements.

You should retain the check for seven days after the deposit has posted to your account. After that time, you may shred it.

CO-OP Shared Branch & ATM Network

In addition to 24/7 account access through home banking, the mobile app, and Audio Access, TN Members 1st Federal Credit Union participates in the CO-OP Shared Branch and ATM Network. This provides our members access to more than 5,000 shared branches and nearly 3,000 shared surcharge-free ATMs across the country! Click below to learn more.

*Please note, CO-OP Shared Branch is not a 24/7 service; however, it provides additional account access options for our members. Hours of availability may vary depending on the CO-OP Shared Branch location, check with individual branches before your visit for a complete list of available services and hours.

Go to main navigation