New Member

Welcome to membership at TN Members 1st FCU! We’re glad to have you as a member! Your financial needs are unique to you and that’s why we offer a wide variety of products and services to help get you easily set up for your goals and lifestyle. We’ve included information below to help you make the most of your membership, including how to:

- Get 24/7 access to your account and enroll in digital services

- Add a new account and set your account preferences and alerts

- Make payments and connect external accounts

- Find member perks and benefits

- Find our fee schedule, privacy policy, and important disclosure information

- Contact the Credit Union

- Learn More About Us

Account Access & Digital Services

Digital Banking

Digital banking is an easy, convenient way to check account balances, pay bills, transfer funds, view e-statements, and more! First-time users will have to enroll in digital banking before they are able to log in. Once enrolled, members can log in to home banking from their Internet Explorer, Firefox, Safari, or Chrome web browser to securely access their account 24/7.

Home Banking Login Digital Banking FAQs

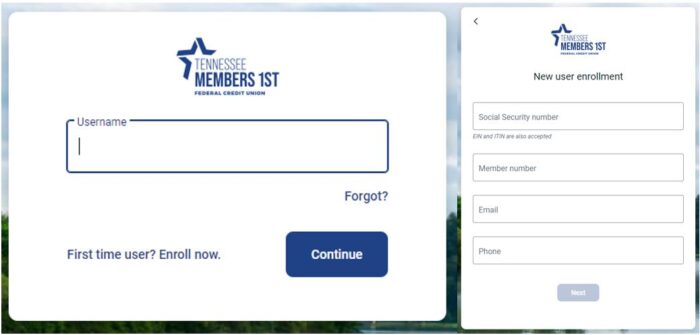

Digital Banking Enrollment

To enroll in digital banking, give us a call at 865-482-4343 or visit go.mymembersfirst.org and click on the ‘First time? Enroll now.’ link. You’ll be asked for your SSN/ITIN/EIN, member number, email, and phone number in order to set up your account.

eStatements

eStatements are electronic versions of your account statements. eStatements are free, let you access eligible account statements online, and offer:

- Speed: Faster delivery of statements, no need to wait for the mail.

- Security: Secure electronic delivery, no paper statements in your mailbox.

- Convenience: Historical statements available online.

You can enroll in eStatements in the following ways:

- Contact the credit union at 865-482-4343 during posted, branch lobby hours, and one of our Member Service Representatives will assist you.

- Message us via digital banking that you’d like to enroll in eStatements.

- Self-enroll using the eStatement platform found by clicking the ‘eStatement’ link in the main, left-hand navigation when you’re logged in to digital banking.

There are more account access options to discover!

Digital banking and eStatements aren’t the only 24/7 account access options you have! Visit our 24/7 Account Access page for all the info on Remote Deposit Anywhere, Audio Response Teller, and Shared Branch options through Co-Op Shared Branch Network!

Account Options & Alerts

Want to open additional savings or maybe apply for a loan? You can do that right in digital banking!

- Log in to your digital banking and click on your name in the bottom left-hand corner of the screen and select ‘Add an Account.’

- A box will pop up that gives you two options ‘Add an Account’ and ‘QCash Application,’ click ‘Add an Account,’ this will load a new page where you can start a new application or check your application status.

Members can also set up alerts to keep track of account activity. Account alerts are configured within digital banking and can be set up individually for each of your accounts with transaction and balance alert options available.

Alerts

- Click on your desired account from either your dashboard using the blue buttons at the top of the screen or by selecting 'Accounts' in the left-hand navigation menu and then selecting your desired account.

- Once in your desired account, you'll click the blue 'Alert Preferences' button on the right-hand side of the screen. This will bring you to the Account Alerts screen where you can edit or add alerts.

- Select edit or add alert to get the options for Text, Email, or In-App Messages. Please note, the phone number and email are brought in through the system and are is the information we have on file for you. If you need to update this information let us know or you can update it by clicking your name in the bottom left-hand corner of the screen and selecting 'Settings' to get into your profile settings.

- Once you've configured the alert to your preferences, hit 'add alert' or 'save' depending on if you are adding a new alert or editing an existing alert.

- Log in

- Select the account you would like to edit an alert for

- Click Alert preferences in the menu or Manage alerts in mobile

- Under Alerts

- Click Edit next the alert you would like to change

- Change your criteria for the alert

- Click Save

- Log in

- Select the account you would like to edit an alert for

- Click Alert preferences in the menu or Manage alerts in mobile

- Under Alerts

- Click Edit next the alert you would like to change

- Click the Trashcan icon or click Remove in mobile

Making Payments & Connecting External Accounts

Members have a few different options for making payments to and from TN Members 1st accounts.

- Bill Pay, located within your digital banking, allows you to make payments from your TN Members 1st accounts to accounts outside of the credit union by setting up Payees and having an electronic or check payment sent on your behalf. These payments are able to be one-time or recurring.

- Bill Pay requires an eligible checking account, enrollment in digital banking, and a one-time enrollment into Bill Pay (must be done on a laptop or desktop device).

- Our Payment Portal, allows you to make payments to your TN Members 1st accounts from a different financial institution using a debit card or account and routing numbers. You can use the Payment Portal for one-time or recurring payments. Recurring payments require a login that will be separate from your digital banking login.

- Payment Portal requires a debit card or account and routing numbers from any financial institution.

Members also have the ability to:

- Add your TN Members 1st account(s) to Venmo using instant verification through Plaid.

- Add your TN Members 1st Debit Card to their Digital Wallet.

- COMING SOON – connect external accounts to your digital banking dashboard for a more complete look at your financial activity.

Bill Pay FAQs Payment Portal Your Debit Card & Digital Wallet

Helpful Links

Contact Us Digital Banking Login Privacy Policy Fee Schedule Member Perks & Benefits

Go to main navigation